24+ kentucky pay calculator

Federal labor law requires overtime hours be paid at 15 times. In Kentucky overtime hours are any hours over 40 worked in a single week.

Kentucky Paycheck Calculator Tax Year 2023

The process is simple.

. Web The state income tax rate in Kentucky is 5 while federal income tax rates range from 10 to 37 depending on your income. Web How do I use the Kentucky paycheck calculator. Simply follow the pre-filled calculator for Kentucky and identify your withholdings allowances and filing status.

Web Use our free Kentucky paycheck calculator to determine your net pay or take-home pay by inputting your period or annual income along with the pertinent. Supports hourly salary income and. Web Kentucky Paycheck Calculator.

This amount is known as the wage base and it can change. Web Kentucky Income Tax Calculator 2022-2023. So the tax year 2022 will start from July 01 2021 to June 30 2022.

Web Kentucky Salary Tax Calculator for the Tax Year 202223 You are able to use our Kentucky State Tax Calculator to calculate your total tax costs in the tax year 202223. There must be at least 1500 in one of. Use ADPs Kentucky Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Hourly Salary Take Home After Taxes SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Web We designed a nifty payroll calculator to help you avoid any payroll tax fiascos. Web The Kentucky Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023.

Your average tax rate is 1167 and your marginal. Web Kentucky tax year starts from July 01 the year before to June 30 the current year. Web Kentucky Paycheck Calculator.

Overtime must be paid at 1 ½ times the hourly rate for hours worked over 40 in a week. Web Employers pay Kentuckys unemployment insurance on the first 10800 of each workers pay each year. Web Kentucky Overtime Wage Calculator.

The Kentucky minimum wage is 725 per hour. If you make 70000 a year living in Kentucky you will be taxed 11493. Web Calculate your Kentucky net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free.

This income tax calculator can help estimate your. Just enter the wages tax. This free easy to use payroll calculator will calculate your take home pay.

Web Effective July 3 2022 the minimum rate is 39 and the maximum rate is 626 per week regardless of how high the wages are. All you have to do is enter each employees wage and W. Web Free Paycheck Calculator.

.jpg?width=850&mode=pad&bgcolor=333333&quality=80)

Germantown Village Apartments 630 East Kentucky Street Ste 2 Louisville Ky Rentcafe

55 Campbell Hill Road Waldoboro Me 04572 Compass

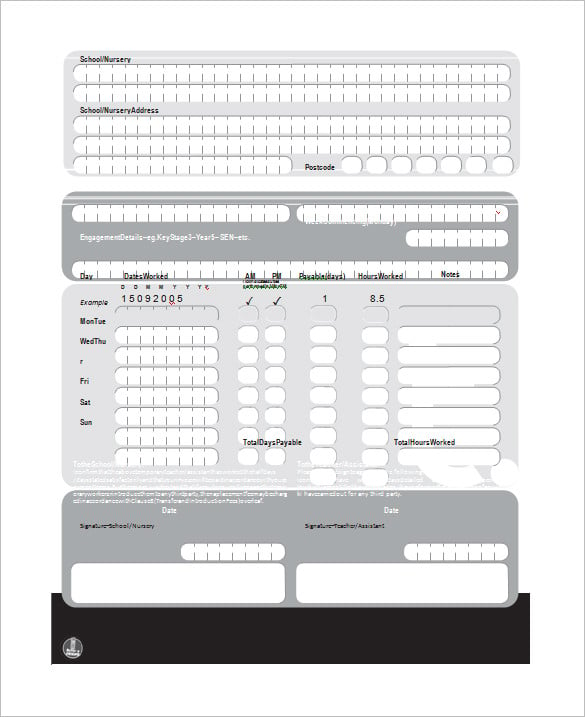

8 Salary Paycheck Calculator Doc Excel Pdf

Master Catalog 74 By Forestry Suppliers Issuu

Wo4laq0faf5ydm

Paye Tax Calculator Pro Amazon Com Appstore For Android

Host Pay Calculator Airinc Workforce Globalization

How To Create A Paid Time Off Pto Policy Free Template

Kentucky Salary Calculator 2023 Icalculator

Falkland Chase Apartments 8305 16th Street Silver Spring Md Rentcafe

Gds Salary Calculation As Per 7th Pay Commission Recommendtion Sa Post

Payrollguru Ios Payroll Applications And Free Paycheck Calculators

2810 George Washington Memorial Hwy Hayes Va 23072 Mls 10270053 Howard Hanna

Wholesale Lendz Financial

323 West Chapman Road Belton Sc 29627 Compass

Us Senate Election Promises

Opt Us Timi Sing Zing G Geo G Sus Osyn Stain Global Synthetics